Budgeit Pay

Budgeit Pay

Budgeit Pay

Pay • Plan • Track • Save

Pay • Plan • Track • Save

Pay • Plan • Track • Save

my approach to simplifying personal finance struggles young adults face.

my approach to simplifying personal finance struggles young adults face.

my approach to simplifying personal finance struggles young adults face.

by

by

by

Urvashi Mendhe

Urvashi Mendhe

Urvashi Mendhe

Payment & PFM app

Payment & PFM app

Payment & PFM app

UX design

UX design

UX design

Gamification

Gamification

Gamification

Design thinking

Design thinking

Design thinking

Design process:

Design process:

Design process:

Design thinking process

Design thinking process

Design thinking process

Scope of work:

Scope of work:

Scope of work:

Product design

Product design

Product design

Project type:

Project type:

Project type:

Personal project

Personal project

Personal project

My role:

My role:

My role:

Product designer

Product designer

Product designer

Duration:

Duration:

Duration:

5 weeks

5 weeks

5 weeks

Published on:

Published on:

Published on:

July 2025

July 2025

July 2025

Urvashi Mendhe

Urvashi Mendhe

Urvashi Mendhe

Please connect for detailed case study

Please connect for detailed case study

Please connect for detailed case study

As a working young adult surrounded by others in a similar phase of life, I noticed a common struggle, managing personal finances.

We often find ourselves caught between the FOMO on fun experiences and the fear of future financial instability.

The result? We end up with neither enough savings nor guilt-free enjoyment.

This made me wonder:

Why do these financial struggles keep happening? What’s really causing these recurring financial problems?

And more importantly, how would I solve it?

As a working young adult surrounded by others in a similar phase of life, I noticed a common struggle, managing personal finances.

We often find ourselves caught between the FOMO on fun experiences and the fear of future financial instability.

The result? We end up with neither enough savings nor guilt-free enjoyment.

This made me wonder:

Why do these financial struggles keep happening? What’s really causing these recurring financial problems?

And more importantly, how would I solve it?

As a working young adult surrounded by others in a similar phase of life, I noticed a common struggle, managing personal finances.

We often find ourselves caught between the FOMO on fun experiences and the fear of future financial instability.

The result? We end up with neither enough savings nor guilt-free enjoyment.

This made me wonder:

Why do these financial struggles keep happening? What’s really causing these recurring financial problems?

And more importantly, how would I solve it?

What I found?

What I found?

What I found?

Target user profile

Target user profile

Target user profile

User interview

User interview

User interview

Desk research

Desk research

Desk research

Target user

Target user

Target user

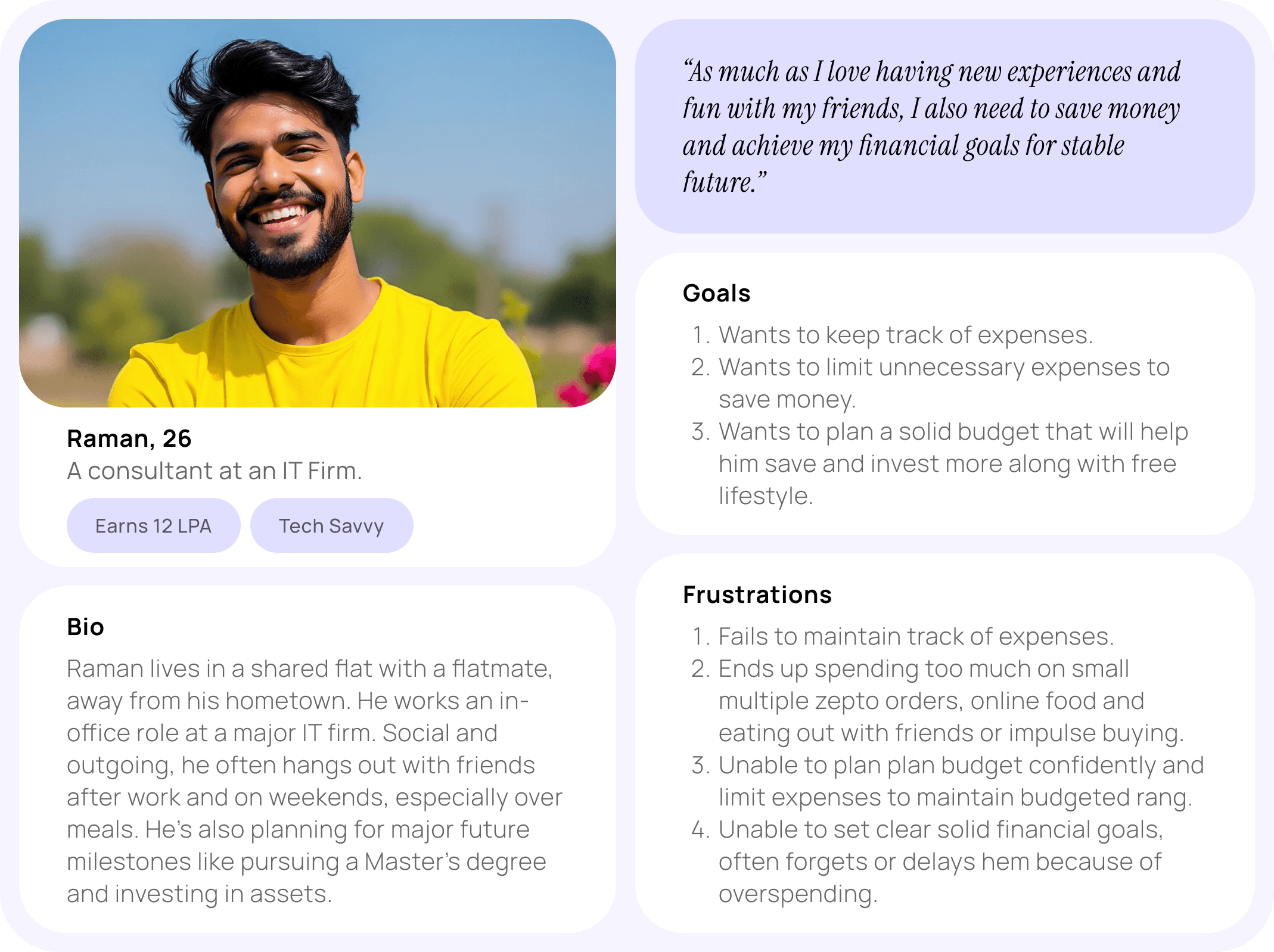

Young working professionals (21–30), tech-savvy and comfortable using digital tools and automation. They prefer online services and are open to securely sharing financial data with trusted apps for better control and convenience.

Young working professionals (21–30), tech-savvy and comfortable using digital tools and automation. They prefer online services and are open to securely sharing financial data with trusted apps for better control and convenience.

Young working professionals (21–30), tech-savvy and comfortable using digital tools and automation. They prefer online services and are open to securely sharing financial data with trusted apps for better control and convenience.

After interviewing the individuals matching target user profile, I found following insights:

After interviewing the individuals matching target user profile, I found following insights:

After interviewing the individuals matching target user profile, I found following insights:

The problems users face

The problems users face

The problems users face

Overspend money without realizing it

Struggle to save and stick to a monthly budget

Lose control once they cross budget, often postpone it to next month.

Don’t know how to create a budget that fits their lifestyle.

Forget or too busy to track expenses manually

Can’t set clear saving goals or follow through with them.

Overspend money without realizing it

Struggle to save and stick to a monthly budget

Lose control once they cross budget, often postpone it to next month.

Don’t know how to create a budget that fits their lifestyle.

Forget or too busy to track expenses manually

Can’t set clear saving goals or follow through with them.

Overspend money without realizing it

Struggle to save and stick to a monthly budget

Lose control once they cross budget, often postpone it to next month.

Don’t know how to create a budget that fits their lifestyle.

Forget or too busy to track expenses manually

Can’t set clear saving goals or follow through with them.

Why this happens

Why this happens

Why this happens

Tracking every single expense regularly is tedious and difficult due to scattered payments across multiple apps and accounts.

Busy schedules and forgetfulness lead to missed expense tracking.

Lack of real-time visibility makes it hard to know how much is left to spend.

Fear of seeing a low balance causes users to avoid checking, leading to overspending.

Lack motivation to save.

Tracking every single expense regularly is tedious and difficult due to scattered payments across multiple apps and accounts.

Busy schedules and forgetfulness lead to missed expense tracking.

Lack of real-time visibility makes it hard to know how much is left to spend.

Fear of seeing a low balance causes users to avoid checking, leading to overspending.

Lack motivation to save.

Tracking every single expense regularly is tedious and difficult due to scattered payments across multiple apps and accounts.

Busy schedules and forgetfulness lead to missed expense tracking.

Lack of real-time visibility makes it hard to know how much is left to spend.

Fear of seeing a low balance causes users to avoid checking, leading to overspending.

Lack motivation to save.

User persona

User persona

User persona

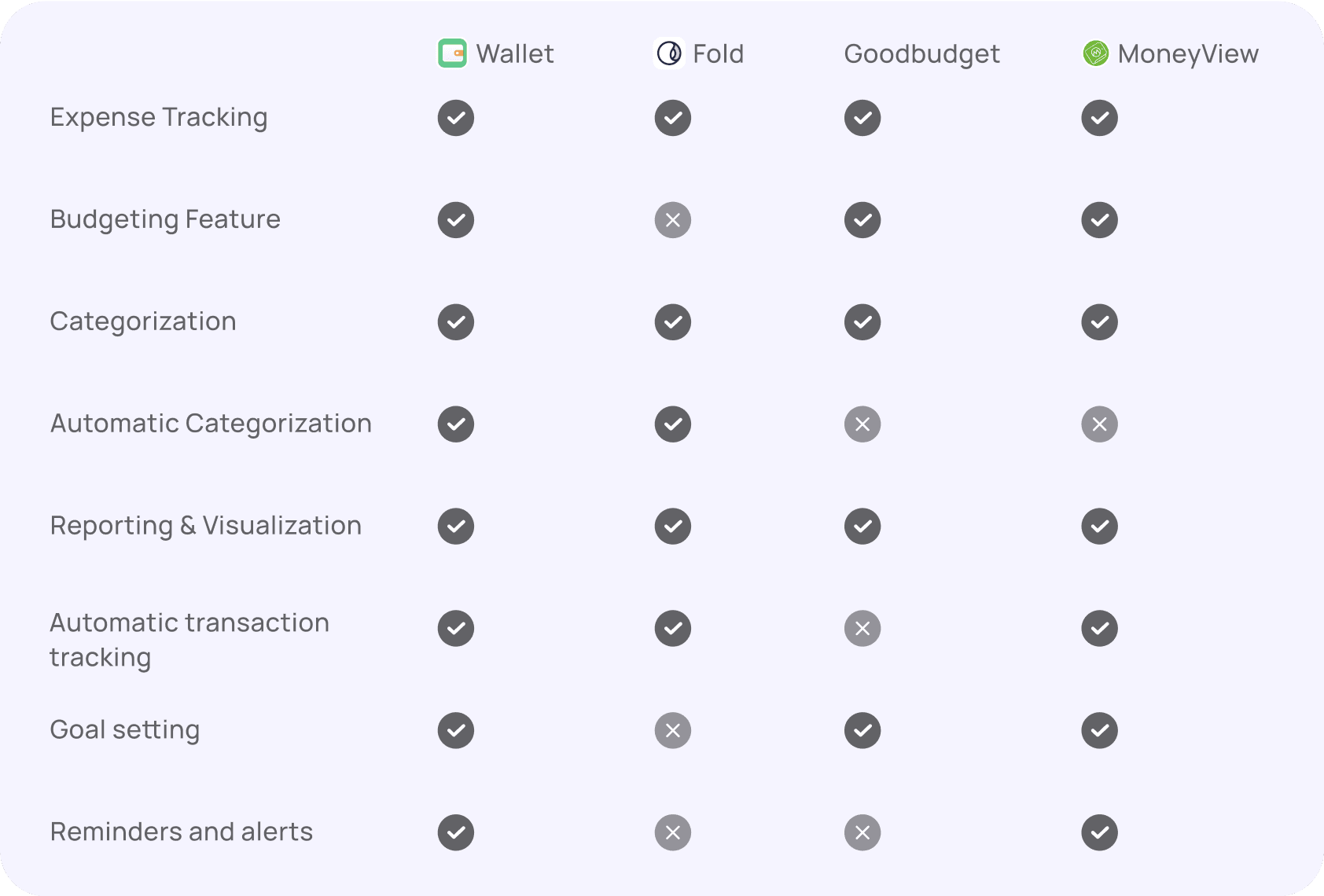

How others are doing it?

How others are doing it?

How others are doing it?

During my desk research, I explored several budgeting and expense tracking apps like Wallet by BudgetBakers and Fold Money. While each addresses some aspects of personal finance, none offer a complete solution.

During my desk research, I explored several budgeting and expense tracking apps like Wallet by BudgetBakers and Fold Money. While each addresses some aspects of personal finance, none offer a complete solution.

During my desk research, I explored several budgeting and expense tracking apps like Wallet by BudgetBakers and Fold Money. While each addresses some aspects of personal finance, none offer a complete solution.

While Wallet app checks all the boxes, like most PFM apps, it still lacks one crucial feature: payments.

You'll soon see why that matters.

While Wallet app checks all the boxes, like most PFM apps, it still lacks one crucial feature: payments.

You'll soon see why that matters.

While Wallet app checks all the boxes, like most PFM apps, it still lacks one crucial feature: payments.

You'll soon see why that matters.

Technical challenges

Technical challenges

Technical challenges

Most Indian personal finance apps lack real-time bank syncing, causing delays in reflecting actual spending. This gap can affect budgeting accuracy and user trust. On deeper research, I found that limitations in Indian bank APIs, like delayed updates and restricted third-party access, make real-time syncing technically difficult.

Most Indian personal finance apps lack real-time bank syncing, causing delays in reflecting actual spending. This gap can affect budgeting accuracy and user trust. On deeper research, I found that limitations in Indian bank APIs, like delayed updates and restricted third-party access, make real-time syncing technically difficult.

Most Indian personal finance apps lack real-time bank syncing, causing delays in reflecting actual spending. This gap can affect budgeting accuracy and user trust. On deeper research, I found that limitations in Indian bank APIs, like delayed updates and restricted third-party access, make real-time syncing technically difficult.

Solution to these technical challenges

Solution to these technical challenges

Solution to these technical challenges

Since this is a conceptual design, I used creative flexibility while staying grounded in real-world constraints. To simulate real-time updates, the app refreshes data frequently (e.g., every 10 minutes) and allows manual refresh for instant insights. I also added predictive expense analysis and proactive nudges to alert users before overspending.

This hybrid approach offers users a near real-time experience and greater financial control, without depending on full real-time API access.

Since this is a conceptual design, I used creative flexibility while staying grounded in real-world constraints. To simulate real-time updates, the app refreshes data frequently (e.g., every 10 minutes) and allows manual refresh for instant insights. I also added predictive expense analysis and proactive nudges to alert users before overspending.

This hybrid approach offers users a near real-time experience and greater financial control, without depending on full real-time API access.

Since this is a conceptual design, I used creative flexibility while staying grounded in real-world constraints. To simulate real-time updates, the app refreshes data frequently (e.g., every 10 minutes) and allows manual refresh for instant insights. I also added predictive expense analysis and proactive nudges to alert users before overspending.

This hybrid approach offers users a near real-time experience and greater financial control, without depending on full real-time API access.

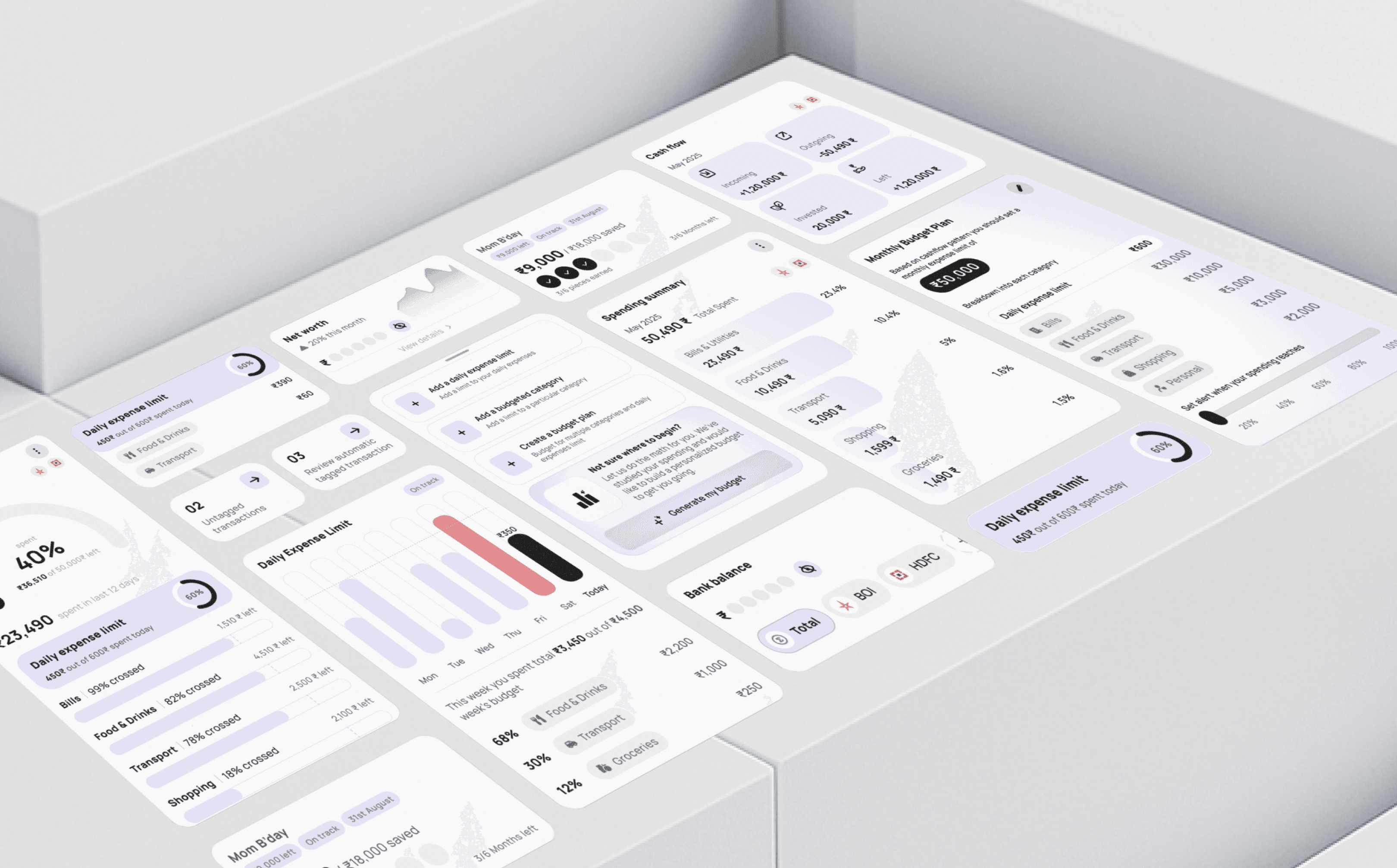

Solution

Solution

Solution

an app that solves all these challenges in a creative way.

an app that solves all these challenges in a creative way.

an app that solves all these challenges in a creative way.

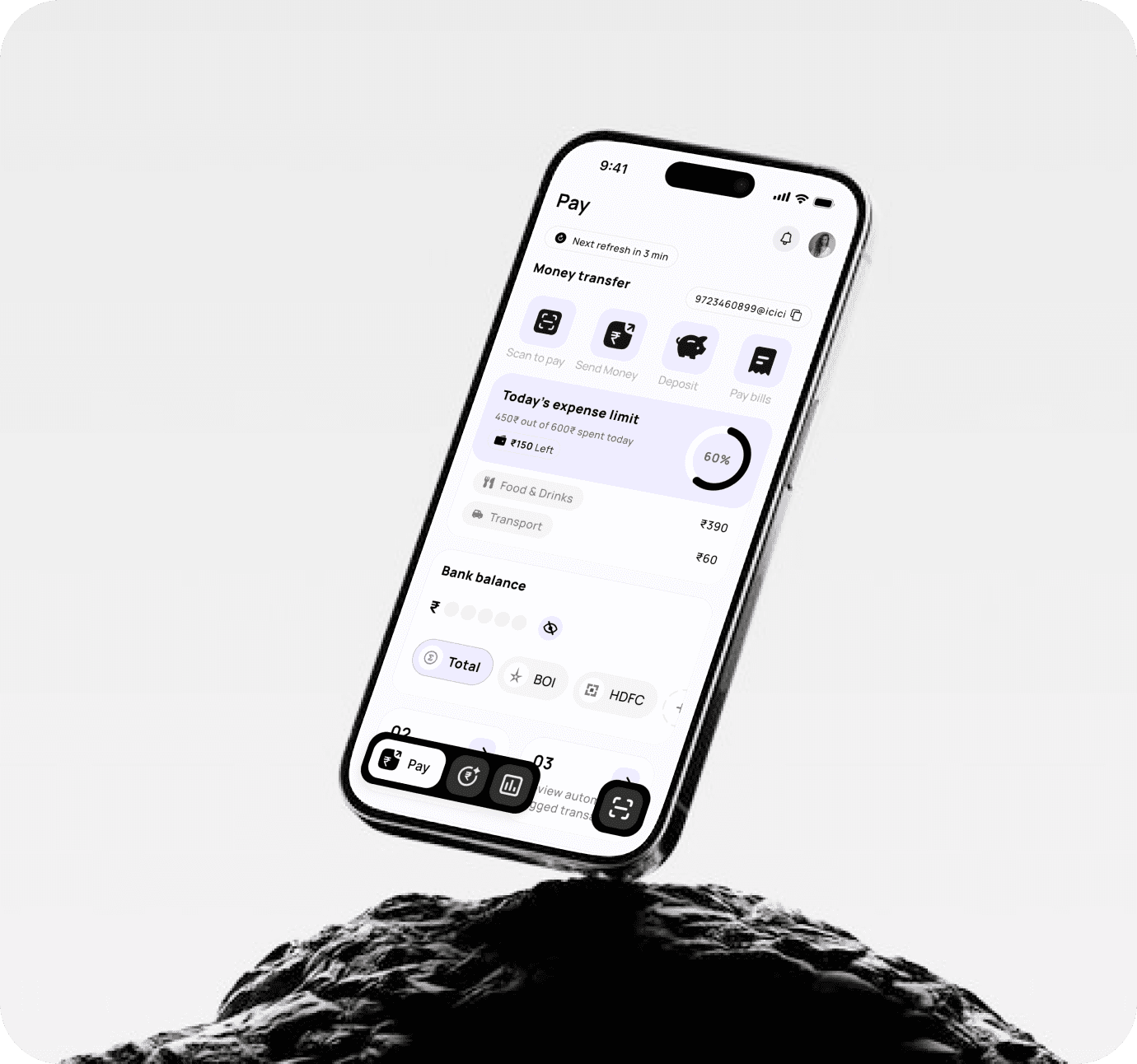

Pay

Pay

Pay

Plan

Plan

Plan

Track

Track

Track

Save

Save

Save

Budgeit Pay

Budgeit Pay

Budgeit Pay

Why add payment feature?

Why add payment feature?

Why add payment feature?

At first, I feared adding a payment feature would complicate things. But the core issue lies in the fact that users have too many apps to manage their money, one for budgeting, another for payments, one for investments, and banking apps for missed transactions. This fragmentation leads to confusion, distractions, and poor financial management.

At first, I feared adding a payment feature would complicate things. But the core issue lies in the fact that users have too many apps to manage their money, one for budgeting, another for payments, one for investments, and banking apps for missed transactions. This fragmentation leads to confusion, distractions, and poor financial management.

At first, I feared adding a payment feature would complicate things. But the core issue lies in the fact that users have too many apps to manage their money, one for budgeting, another for payments, one for investments, and banking apps for missed transactions. This fragmentation leads to confusion, distractions, and poor financial management.

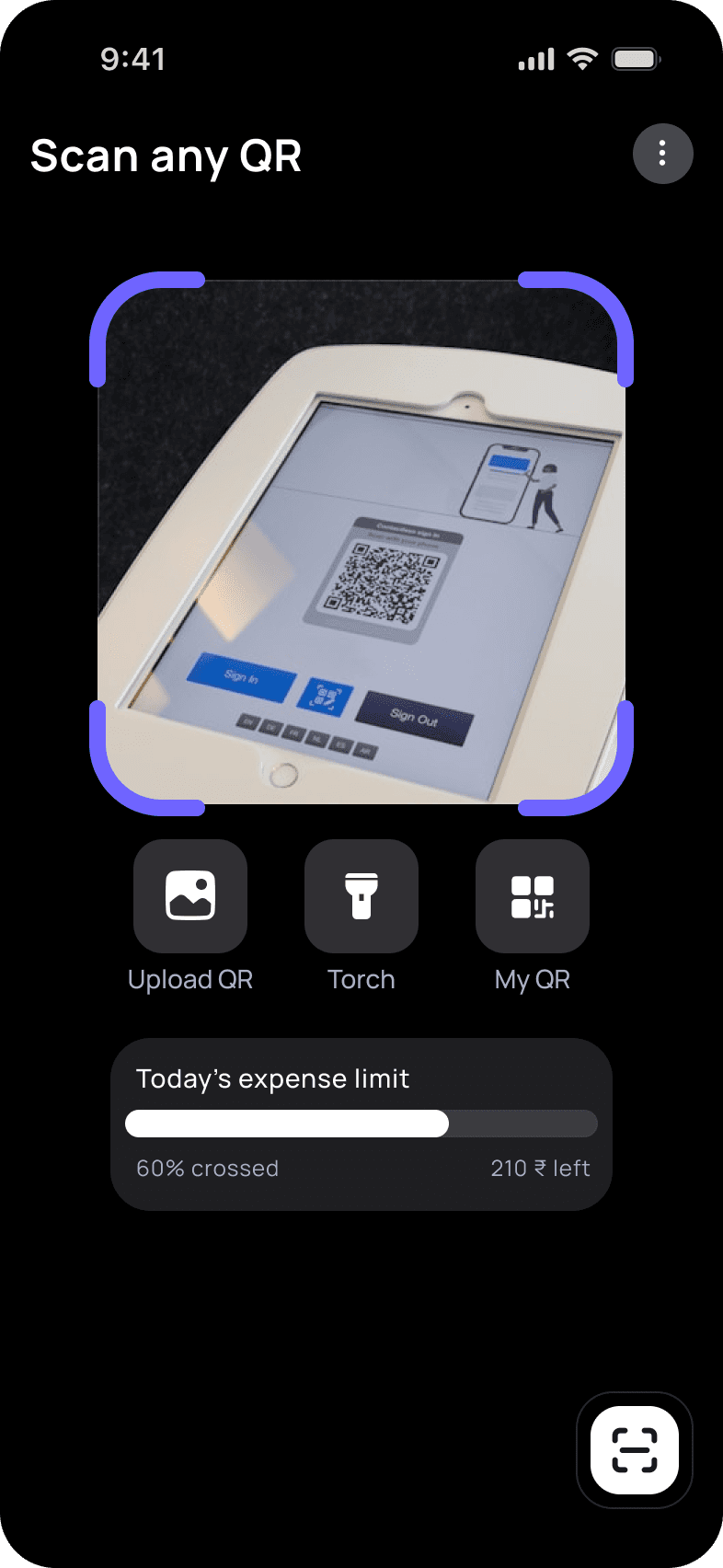

Help users spend consciously

Help users spend consciously

Help users spend consciously

Set daily expense limit and show the limit progress in a visual progress bar near payment options so that the user gets a gentle nudge on how much he has spent and how much he has left to spend for the entire day.

Set daily expense limit and show the limit progress in a visual progress bar near payment options so that the user gets a gentle nudge on how much he has spent and how much he has left to spend for the entire day.

Set daily expense limit and show the limit progress in a visual progress bar near payment options so that the user gets a gentle nudge on how much he has spent and how much he has left to spend for the entire day.

Set savings goals

Set savings goals

Set savings goals

Making saving goals fun to achieve through gamification

Making saving goals fun to achieve through gamification

Making saving goals fun to achieve through gamification

Self determination theory

Self determination theory

Self determination theory

Intrinsic motivation

Intrinsic motivation

Intrinsic motivation

Freedom of control

Freedom of control

Freedom of control

Zeigarnik Effect

Zeigarnik Effect

Zeigarnik Effect

Competence

Competence

Competence

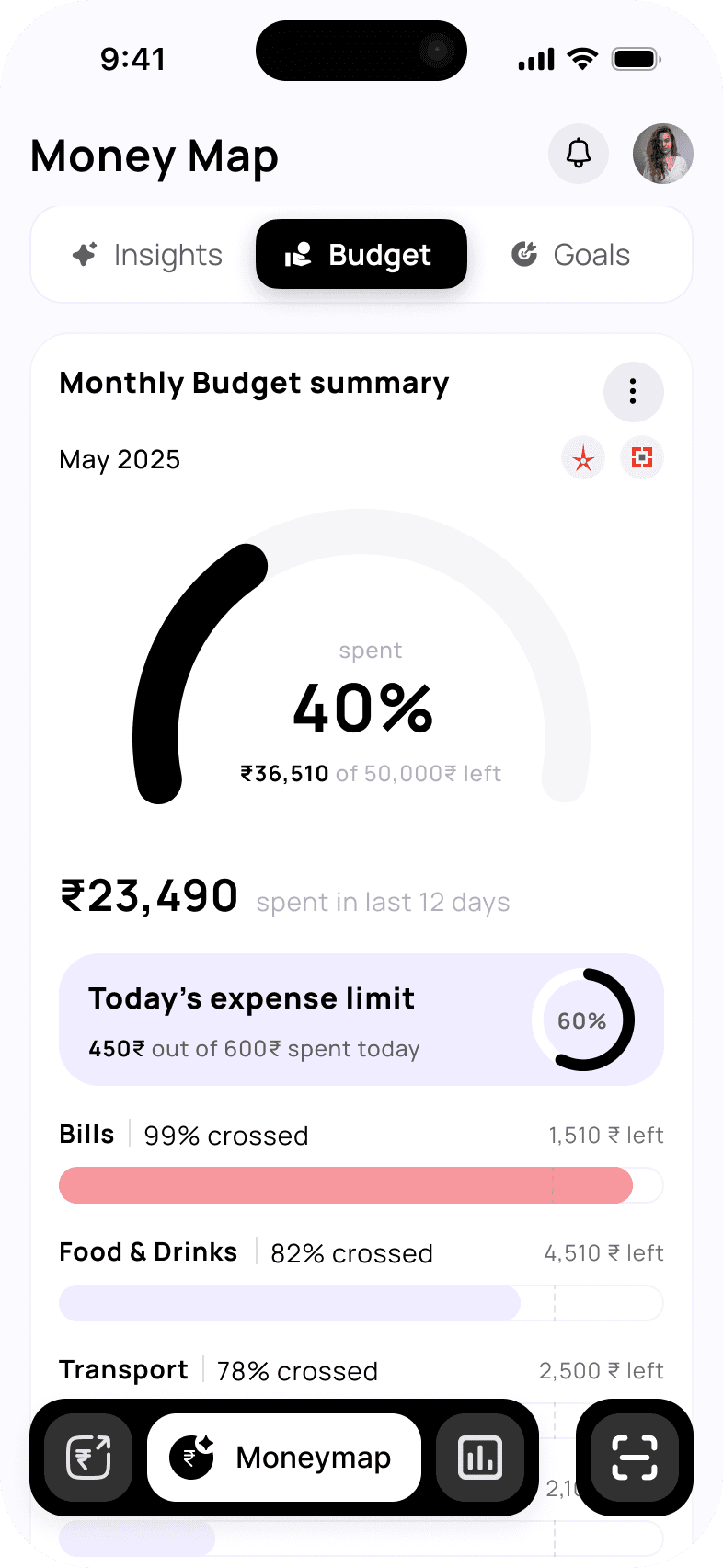

Smart budget plan recommendation

Smart budget plan recommendation

Smart budget plan recommendation

Gentle nudges to alert users when they cross a set budget limit.

Gentle nudges to alert users when they cross a set budget limit.

Gentle nudges to alert users when they cross a set budget limit.

Smart insights

Smart insights

Smart insights

Get overall expense and savings insights in a screen.

Get overall expense and savings insights in a screen.

Get overall expense and savings insights in a screen.

Minimal navigation

Minimal navigation

Minimal navigation

What’s next?

What’s next?

What’s next?

Next, I would explore solutions for helping users manage credit cards more effectively, making it easier to build a healthy credit score and avoid debt traps.

I would also design personalized investment suggestions tailored to each user’s spending and saving patterns.

Next, I would explore solutions for helping users manage credit cards more effectively, making it easier to build a healthy credit score and avoid debt traps.

I would also design personalized investment suggestions tailored to each user’s spending and saving patterns.

Next, I would explore solutions for helping users manage credit cards more effectively, making it easier to build a healthy credit score and avoid debt traps.

I would also design personalized investment suggestions tailored to each user’s spending and saving patterns.

Thank you!

Thank you!

Thank you!

Interested in the full design process? I’d love to walk you through it, feel free to connect!

Interested in the full design process? I’d love to walk you through it, feel free to connect!

Interested in the full design process? I’d love to walk you through it, feel free to connect!